With the development of seven different systems within Asirikuy, the testing of these system on live accounts and the development of adequate tools for draw down analysis. I have realized that it is time for us to start a well laid out plan in Asirikuy for long term capitalization. Up until now, since the performance of joint portfolios was not known there was no clear information of what a "good portfolio" would be and what money adding tactics would work best to ensure that our portfolios would have the best performance over long periods of time. However, after modifying the experts to work with an internal balance solution and analyzing their joint simulations, it is safe to say that we now have a very good idea of what seems to be possible using Asirikuy automated trading systems.

Today I am very proud to announce another milestone in the development of Asirikuy, the start of the Atinalla project. This word which - you guessed right - comes from the Quechua language of ancient Bolivian, Colombian and Peruvian natives simply means "possible". I want to be absolutely clear in that what I am about to release does sound too good to be true and in order to be absolutely honest I will tell you that I cannot guarantee that we will obtain the results given below. What I can guarantee is that we will have clear profit, draw down and worst-case scenario targets and even though this may be experimental, it may prove a reality over time if the analysis is correct.

The objective of the Atinalla project is simple. I want to get a dedicated trader from an initial investment of 1000 USD to a five figure yearly income in 10 to 15 years by using purely mechanical trading systems. To do this I have paired up different Asirikuy systems - which up until now have back/live testing consistency - and I have designed a strict yearly money addition protocol of 1200 USD and a way of trading the systems that ensures maximum profitability.

I have also realized that with my particular choice of systems, the actual continuous compounding effect is detrimental to yearly profits as favoring the previously most profitable systems appears not to be the best tactic. I suspect that this is probably due to the fact that expert advisors have years of high profitability followed by much less profitable periods and having all experts always start the year with the same capital offers a much better effect in the long term. By resetting the initial balance of the systems each year to make them all trade the same initial capital (plus any yearly additions) will make the systems achieve much higher profit targets in combination. This is evident when you look at the yearly profit and draw down targets shown below.

-

-

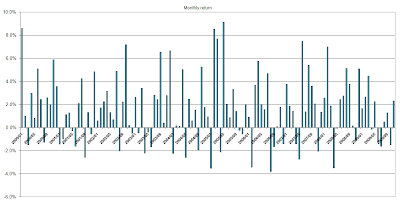

-Since this includes separate backtests for each system for each year, it can be safe to say that the "starting point" of the portfolio is not extremely relevant to draw down targets. The maximum draw down achieved by the above portfolio during the 10 year period is roughly 18% and the profit target of the portfolio is in average 65% after ten years. The standard deviation of the profit percentage is huge (32%) showing that if yearly profitability in the long term follows a normal distribution (of course, this is an assumption but the current data suggests it) we may go from 161% to -31% years in the very long term. However the standard deviation for draw downs is much lower and this analysis suggests that yearly draw downs may go from 1% to 25% in the long term. The year 2010 - which has not ended yet - was not taken into account for the average profit and draw down analysis. The maximum days of draw down have an average of 99 but the standard deviation - which is quite large - suggests that we may have a maximum yearly draw down period near 230 days in the future.

-

-

-A graph of the above mentioned yearly profit and draw down figures shows what appears to be a great trading portfolio achieving profit over all years during the past 10 years and having extremely moderate draw downs consequence of the hedging character of the different strategies. Of course, there are some years in which the temporary draw down comes near the experts' yearly profit but in the end all years end up with higher profits when compared with draw downs.

-

One of the most interesting things I thought I would do was to calculate the 2010 results for this portfolio using current Asirikuy live trading data. Using the systems included in the portfolio (with some live accounts having fortunately the same risk level, making them adequate for comparison) and adding their results together I could get a profit of 35%. However, one of the experts used on the portfolio has only been trading since April so this profit figure - which neglects a very important January and February profit shown in backtesting - is below what should have been achieved for this year. This shows not only that the live portfolio is in line with the backtests for the year (backtests do not include May, reason why live testing shows about 10% more profit) but that the experts do have synergy when traded together.

What we have with Atinalla is a clear target and a clear way to achieve it based on sound evidence. The systems will be traded in a portfolio, resetting the initial balance each year (to the final yearly capital plus addition for all systems) and doing a 1200 USD addition starting with a 1000 USD initial investment. We will expect a maximum draw down of 18% and our worst case scenario will be a 36% draw down level. We have a projected average profit level of 65% after ten years but we will expect anything from -31% to 161%. The important thing here is NOT to look at the profit values but at the draw down targets, we have absolutely clear, well designed worst-case scenario levels which will trigger our "stop trading" signal if they are reached. So if anyone trading this portfolio reaches a 36% draw down, no more trading will be done since the systems have become to risky to continue trading.

Of course, Asirikuy members will find a page this Sunday including all Atinalla testing information as well as the settings required to run each expert advisor and a video explaining how I did all the tests, how to load the experts on your account, etc. Doing this analysis to come up with the first Atinalla portfolio took a long time but many other portfolios will certainly come as time evolves and new good combinations become apparent. We will also open up the Atinalla challenge for people willing to start trading the above portfolio with a commitment to stick with it from 2 to 10 years on a VPS.

Will Atinalla provide people with financial freedom ? Will it be able to achieve a five figure income for someone after 10-15 years ? Will we reach the worst-case scenario ? Will people endure the harsh draw down periods and low profitability years ? All these questions will be answered within the next ten years within Asirikuy :o) If you would like to learn more about my trading systems and how you too can build expert advisors based on sound trading tactics please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !