However, upon a closer inspection of how the successful systems I know work and their trading characteristics I have come to a set of conclusions that show us why - even if everybody knew them and traded them - only a few people could ever be succesful using them. On today's post I will discuss the five main ways the market protects itself from the massive exploitation of mechanical systems giving you an idea of what you are getting into if you want to achieve long term profits with expert advisors.

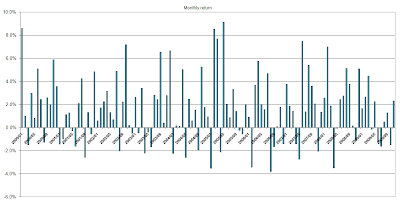

1. Profitable systems have long draw down periods. One of the things that I think makes the massive exploitation of long term profitable systems likely impossible is the fact that draw down periods of profitable systems are extremely long and very hard to endure for most people. If you don't understand what the system does and you have been in draw down for 300 days, then common sense would dictate you stop trading the system. When people trade something they don't understand they easily fall prey to fear while if they attempt to have "faith" on the system they will get their accounts wiped if the system stops working.

2. Worst historical draw downs always get worse. Another very important aspect is the fact that the market will show you a darker side of its face as time evolves. I have seen many people trade systems with high risk levels saying "in a 10 years backtest its maximum draw down was 60%, so I'll be fine". This is a big mistake. The worst performing point in the past does not forecast the worst point in the future. A system may go into a deeper draw down in the future and if your risk measurements don't take a deeper draw down into account the system's future regular profit/draw down oscillations will take you out.

3. Long term profitable systems are unattractive. People generally look for systems that show short term results, high profit rates and high recoveries from loses and therefore long term profitable systems simply fail to attract people. If you were selling these systems probably only a bunch of people would ever buy them and this is because their profit targets are not very high and their draw down periods are long and their draw downs deep. So in the end people are simply not attracted to these systems and prefer to trade much more dangerous systems.

4. They give back. I think that a very good reason why people don't like long term profitable systems is because they have a strong tendency to give back profits a significant amount of the time. The turtle trading system can have a 1800 pip profit and come out with a 200 pip loss. Most people will get angry, won't understand this and will run away from the system saying that it doesn't work. They simply do not understand the reason why this "giving back" happens and why it is done to preserve the probability to achieve a trading system's potential.

5. True understanding is needed. Due to all the above reasons, the chief protection of the market against the massive exploitation of mechanically tradable inefficiencies is the fact that a true understanding of the systems is necessary. If you set and forget you will fail due to the above reasons. You will probably get out on a predicted draw down cycle, modify the system eternally to try to make it "avoid giving back" or you may just attempt to trade the system on blind faith and wipe your account when the system has simply become too risky to be traded.

After I realized the truth behind all the above reasons, the design and trading of long term profitable systems became much easier. In the end the most important thing is to know exactly what the system is doing, why it is bound to work, how it works under varied market conditions and why and when the system is bound to make profitable trades. It is extremely important to know the long term statistical characteristics of the trading systems and to constantly evaluate the performance of the strategies against what you learn from previous live trading and simulations. In the end few people will be able to achieve the understanding needed to defeat the market at its own game. Hopefully you'll be one of them :o)

If you would like to learn more about automated trading and how you too can design and trade your own long term profitable systems please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !