To tell you the truth, it was not easy to come up with a release candidate for Watukushay No.5. I have been developing and evaluating systems none stop and - as a matter of fact - this has led to the finding of some very interesting trading techniques which have shown likely long term profitable results in 10 year backtests with acceptable trading characteristics. I have shared with you some of these developments such as the Bollinger Band strategy I wrote a blog post about a few weeks ago.

However I didn't feel any of these tactics were suitable for Watukushay No.5 since none of them had the multiple instrument potential I wanted for the next Asirikuy trading system. With the achievements of Teyacanani in mind, I decided that I wanted to create a system that could achieve good trading characteristics on several currency pairs and which had enough flexibility to exploit various types of inefficiencies with a simple change of settings. After a lot of searching and a lot of evaluation (and a fortunate email from an Asirikuy member who reminded me of some previous work) I have found a trading method that will be the core of Watukushay No.5.

This new Asirikuy EA is a daily breakout system that looks for trading opportunities everyday based on certain price ranges or "boxes" that may develop. The expert advisor looks at a specific period of time and sets pending orders if the characteristics of the ranging periods are adequate. As Kutichiy (Watukushay No.3), this EA uses an entirely adaptive technique which fits all the characteristics of the EA as multiples of the assigned range. It is interesting to see how many inefficiencies can be found through the trading of breakouts of consolidation periods and how these consolidation periods turn out many times to be non-conventional. The image below shows you a sample of a favorable trade of Watukushay No.5.

-

-

I have worked a lot on this EA and I have already found several long term exploitable inefficiencies based on such breakouts. Trading on the EUR/USD, this EA is able to achieve results as good as those of Watukushay No.2, however the great thing about this EA is not its mere ability to profit from this currency pair but its more "universal" character. With the flexibility to change the breakout character, the characteristics of the box, the take profit, buffer and the actual trading or "fading" of the breakouts Watukushay No.5 is fit to trade a broad range of possible inefficiencies on several different instruments. Since this breakout system is very different and much more flexible than Kutichiy its potential for portfolio trading is MUCH higher.

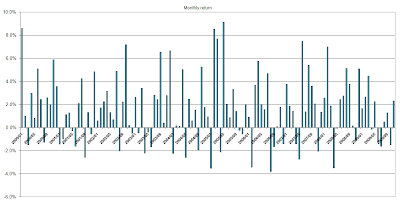

Perhaps the largest difference between the release of Watukushay No.5 and the rest of the Watukushay expert advisors is that I released this EA at a somewhat early stage of development. My objective with this is to encourage the participation of the Asirikuy community so that new inefficiencies on other currency pairs can be found and a large scale analysis and coarse optimization of the trading system on many currency pairs can be done. Watukushay No.5 is not yet ready for live trading but it is still within what I would like to call an "Asirikuy community Beta" in which I hope members on the website can team to analyze the EA and use it to find trading tactics to trade a wide variety of currency pairs. (below a EUR/USD backtest from Jan 2000 to Jan 2010)

-

-

-The great thing about the EA is that it can be fit to test extremely different tactics on many different currency pairs, it can be used to trade Asian session breakouts on the GBP/USD or it can be used to fade breakouts of the European session on the EUR/CHF, etc. The trading system has incredible flexibility and it has the possibility to take profit from a large variety of market situations that may show to constitute long term inefficiencies. Of course, I also expect we can add some additional closing mechanisms if our analysis within the next few months demonstrates that such additions would prove to be improvements to the expert's logic.

Right now I have great expectations for this EA which has already shown its potential to achieve good profit and draw down targets on a few currency pairs. Will we be able to join as a community and evaluate and examine this trading system ? Will new and exciting ways of trading daily breakouts arise from the forum ? Right now the results of this trading system already point to its future outcome as a strong Asirikuy system and certainly I believe that the Asirikuy community forum approach will only make it better.

As for the name... We will be making a poll in the forum and we will name it when the first live account comes out :o)

If you would like to learn more about the Watukushay project and how it seeks to develop trading systems with sound trading techniques and realistic profit and risk targets please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !