The JPY crosses are a series of instruments in the forex market that pair the Japanese Yen with a non-USD currency. These instruments are most commonly EUR/JPY, GBP/JPY and CHF/JPY but other more exotic pairs like NZD/JPY and AUD/JPY are also available. These pairs have some very notable characteristics which set them apart from regular forex pairs like the EUR/USD and the GBP/USD. What makes them so special is the extremely large daily volatility and their overall lack of liquidity (when compared to major pairs). Developing a system for these babies is no easy ride and I will just show you why this is the case.

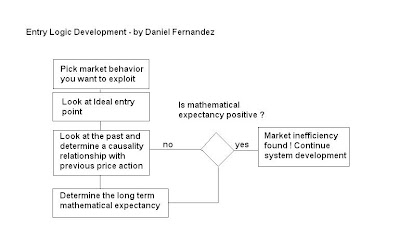

System development is based on the finding of exploitable market inefficiencies. Price behaves in a certain way that allows you to enter a trade with a high probability of success under very diverse market conditions. Lack of liquidity introduces a blur to this image and therefore it becomes very hard to find inefficiencies because price is "all over the place" so to speak. Lack of liquidity makes different price patterns appear on very different market situations signaling many different things taking your mathematical expectancy away from positive territory. So if you try to trade a given candlestick pattern you find that the pattern sometimes leads to where you want to go and sometimes it doesn't - like it always happens - but the lack of liquidity increases the number of times it leads to where you don't want to go significantly, to the point where you lose all the edge you would have gained from it.

For this very reason, the development of price based strategies on the JPY crosses is often not a good idea since you are very vulnerable to the "blur" introduced by the general lack of liquidity of these instruments. Systems that have success on very varied currency pairs - like Teyacanani - simply fail to profit on JPY crosses due to the fact that their signals simply don't lead anywhere. After analyzing 10 years of price data for the EUR/JPY I have found that price action is extremely hard to predict due to the fact that lack of liquidity makes it follow a very random walk in the short and perhaps medium term. This is the exact effect you would expect from lack of liquidity since crowd behavior becomes less representative and more individual human behavior - which is just random - starts to show through the charts.

What is the solution then ? Since price action based strategies seemed to fail to bring positive results on these currency pairs for me, I decided to change into indicator based strategies that allowed me to remove the "noise" from the market more effectively. The idea here is that JPY crosses do follow crowd behavior in the long term so introducing a strategy that averages data and gives me an idea of where things are going would most likely prove more effective. This is in fact the case and indicator based strategies do show positive mathematical expectancy values with less effort. However, the fact that the currency pairs lack liquidity makes the eventual profitability of these strategies much lower than what can be achieved on the regular USD paired instruments.

In the end it becomes obvious that lack of liquidity complicates any mechanical profitability to a large extent since market inefficiencies become far more scarce and difficult to capture. Lack of liquidity makes the effect of smaller parties larger and therefore the movements are just more random overall. Crowd behavior becomes less significant and therefore we lose a significant edge that we are able to use on major currency pairs. Many of you may think that this "randomness" constitutes an inefficiency on its own but the fact is that it does not since you aren't able to predict when it will appear with a statistical advantage. If you assume that JPY crosses are random and attempt to profit from their volatility you will fail when they trend and vice versa. The problem is not the character of the instruments but the fact that lack of liquidity does not allow us to have a positive statistical edge on most strategies.

Does this mean that we won't have any mechanical JPY-cross trading strategy ? No, it just means that it will be much harder to develop and probably profit and risk targets won't be as good as for regular systems based on more liquid currency pairs. As a matter of fact I am currently developing some strategies to address these JPY crosses. Hopefully I will be able to tackle this beast and - in the end - we will have some likely long term profitable systems for our JPY trading friends :o)

If you would like to learn more about automated trading and how you too can learn to design and develop your own trading systems with sound trading tactics please consider buying my ebook on automated trading or joining Asirikuy to receive all ebook purchase benefits, weekly updates, check the live accounts I am running with several expert advisors and get in the road towards long term success in the forex market using automated trading systems. I hope you enjoyed the article !